ASIC Reporting Solution

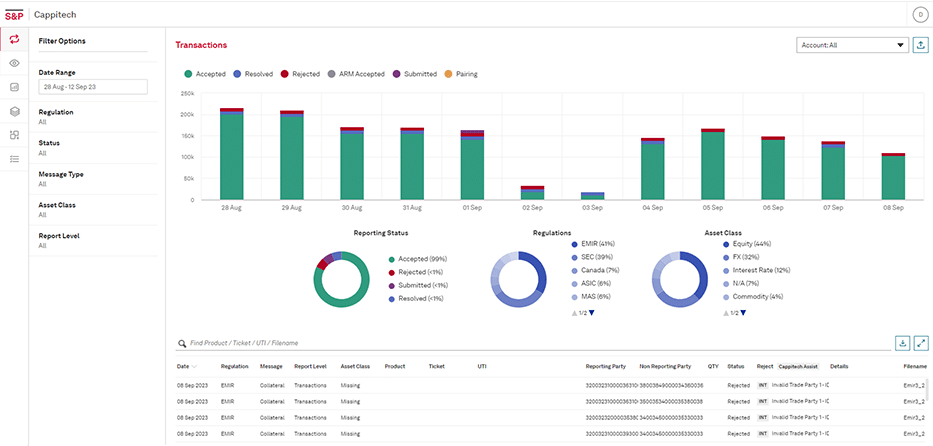

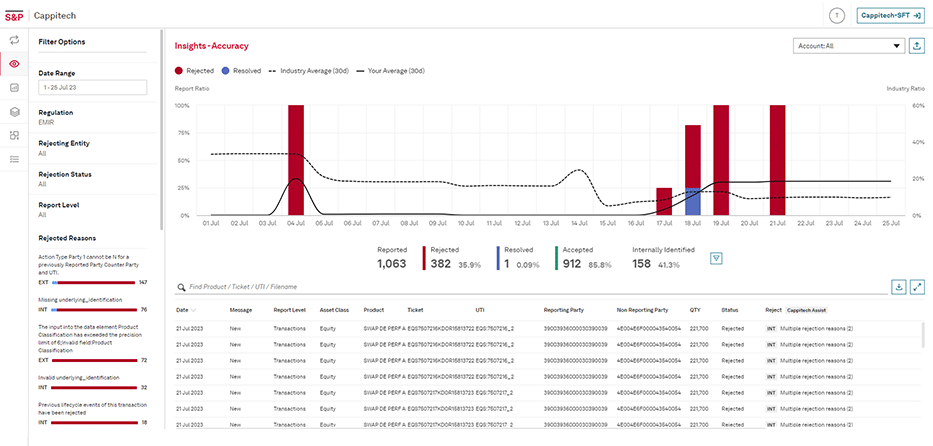

Cappitech’s 100% accurate platform provides you with seamless, automated ASIC reporting, allowing you to easily connect with trade data to create ASIC compliant formatted files. It gives you simple, headache-free ASIC reporting – just how it should be.

From the moment it came into effect in 2015, ASIC reporting has become a massive and expensive problem for brokers, banks, and fund companies alike. Retail FX and CFD brokers, asset managers and banks suddenly needed to comply with complex – and budget draining – new reporting rules.

How Cappitech can solve your ASIC reporting obligations

What is ASIC derivative reporting?

ASIC derivative reporting regulation put in place daily reporting obligations of OTC derivative transactions. Other than certain company types of which exemptions apply, reports cover transactions for both intra-day and overnight held positions.

What data needs to be reported under ASIC derivative reporting?

Fields required to be reported per trade include information on counterparties, instrument, price and notional amount details of the transaction, daily valuations and margin figures.

Can you report full lifecycles of trades or only positions?

For non-exempt trades, ASIC derivative reporting regulation explains the submissions types within the legislation under 2.2.1(a) & (b).

- a – states requirement for reporting each reportable transaction

- b – each reportable position

For the reporting position portion of the report, there are two options that can be used:

- Compress individual reported trades from (a) and report an end of day position per product per customer

- Report each transaction from (a) as a separate position. However, this means you also have to report when that trade is closed and send a termination report for that position.

Are snapshot reporting exemptions still applicable to CFD brokers?

No, as of July 2019, exemptions that allowed CFD brokers to solely report end of day positions has been removed. Currently, CFD brokers need to report both intraday transactions and daily positions.

Where are reports submitted to?

As of December 2020, the DTCC is the single Trade Repository supporting receiving of submissions of ASIC derivative reports.

Learn More