Cappitech Consulting: Takeaways for optimizing compliance and operational efficiency in 2026

As we approach the end of 2025, it is pertinent to reflect on the evolution of the trade and transaction reporting landscape over the past several years. The industry has navigated numerous REFITS and Rewrites across North America, Europe, and the Asia-Pacific region. Looking ahead, 2026 is poised to be a transformative year without significant regulatory change on the horizon.

Without the next regulatory go live date in front of most firms, 2026 is the opportune moment to ensure your organization is well-prepared across two key areas:

- Operational Resilience and Expertise

- Focus on Data Quality of Reported Data

Operational Resilience and Expertise

Project teams that previously supported various rewrites have largely transitioned to other initiatives, leading to a return to business-as-usual (BAU) reporting. Subject Matter Experts (SMEs), business analysts, project managers, and data architects have moved on, leaving the responsibility of managing diverse reporting obligations to operations teams.

For larger clients, such as banks and buy-side firms, dedicated regulatory operations teams focus specifically on compliance with trade and transaction reporting obligations. However, these teams often face resource constraints as they juggle multiple urgent issues, including data generation, submission, exception management, reconciliation, and oversight of errors and omissions.

We have observed this firsthand with clients striving to address daily reporting challenges but lacking the necessary expertise to manage the complexities inherent in regulatory reporting.

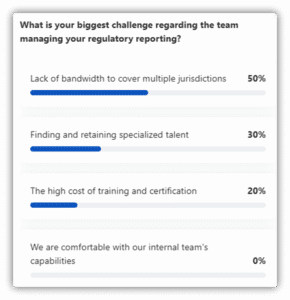

During a recent Cappitech Consulting webinar, we conducted an audience poll that highlighted the challenges and concerns faced by clients on both the buy-side and sell-side in managing their operations. This raises the question: why continue to navigate these challenges alone?

Clients across buy side and sell side clearly have identified the challenges and concerns they have in managing operations. So, the question is why keep doing it?

Cappitech’s RegOps Managed Services was born from witnessing clients struggle with the same issues and figuring out we are perfectly placed to help them alleviate some of those issues.

Cappitech’s RegOps Managed Services has developed this capability to address 3 core areas for our clients:

- Cost Effectiveness & Predictability

Regulatory Operations Managed Services are contracted on a multi-year subscription basis to give our clients cost certainty and predictability, without having to worry about disruption of staff turnover.

- Flexible Resourcing & Scaling

Our resources can be deployed on, near or offshore to serve the bespoke needs of your business and align with where your stakeholders are located. As you launch a new product, fund, engage in M&A activity or navigate other reporting changes, our teams scale seamlessly with you, enabling efficient resource allocation. Cappitech will handle all the hiring and training to allow to you react quickly to changing business needs.

- Focus on core business

Operations teams are often stretched thin, treating regulatory functions as a cost center. They rarely have the bandwidth to master new regulations or manage complex processes like Errors and Omissions. By leveraging Cappitech’s proven expertise, you can redirect your team’s energy to focus on the core business.

Data Quality

Since after the 2022-2025 G20 derivative reporting rewrites, supervisors’ focus has shifted from collection to data-driven supervision and oversight. The regulatory reporting Industry has started to witness firsthand that regulators are actively reviewing data and looking for anomalies in their respective jurisdictions, globally.

Market participants understand high-quality, well-controlled data is the cornerstone of effective regulatory reporting. As regulators and supervisors intensify their focus on the usability of trade and transaction data, firms must ensure that data reported to Approved Reporting Mechanisms (ARMs) and trade repositories (TRs) is complete, accurate, and timely.

Robust data quality frameworks and control environments not only enable regulators to perform their supervisory mandates (safeguarding market integrity, resilience, and stability) but also protect firms from compliance risk, operational inefficiencies, and reputational exposure. Investing in strong data governance and validation processes is therefore both a regulatory expectation and a strategic necessity.

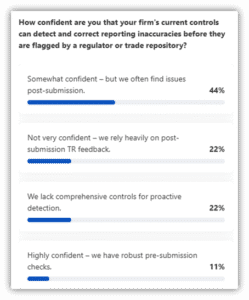

During a recent Cappitech Consulting webinar, we ran an audience poll asking about firms’ confidence in their current ability to monitor the quality of their reporting and correct identified issues:

More than half of the firms answering our poll were clearly running post-submission controls on their data but were surprised to discover issues after having reported. This proves they have and run the necessary and expected levels of controls, allowing them to improve pre-reporting checks based on post-reporting findings.

Firms intentionally run “good enough” checks pre-submission to ensure timely and complete reporting, improving this over time with robust post-submission control frameworks, ultimately creating self-improving regulatory reporting operations. Cappitech Consulting actively helps firms design, build and run the necessary controls in a post re-writes world.

A quarter of firms answering our poll also admitted not having adequate control frameworks in place and being reactive based on TR feedback, rather than proactive.

Cappitech Consulting has the ability to assist firms with independent pre and post reporting controls covering the full required range:

- Detect over and under-reporting vs Books

We help firms ensures that all reported derivative transactions are captured and reconciled against internal books and records, identifying missing or duplicate submissions that could distort regulatory data at the ARM or trade repository.

- Detect misreporting vs Books

We assist firms in comparing reported data fields with internal trade capture systems to identify inconsistencies or inaccuracies in key attributes such as counterparty details, notional amounts, or product classifications.

- Detect inaccurate reporting beyond Trade Repository or ARM validations

We empower firms to go beyond basic submission checks to assess data accuracy and completeness across the full reporting lifecycle, ensuring compliance with regulatory standards even beyond ARM or validations, to ensure reported data is business accurate and usable by supervisors.

- Monitor errors & omissions

Whether firms aim at taking on the monitoring of errors and omissions themselves or not, Cappitech Consulting can help through our ability to take on your regulatory reporting operations leveraging our RegOps Managed Services offering or have Subject Matter Experts look at a pre-defined reporting sample, we are able to ease firms’ need to establish continuous monitoring and exception management processes themselves to track reporting breaks, late submissions, and rejected trades, enabling timely correction and notification (where applicable).

- Plan and deliver remediation projects

We partner with firms to design and execute structured remediation programs to resolve systemic reporting issues, enhance control frameworks, and prevent recurrence through process improvement, automation, and governance alignment.

To learn more about Cappitech Consulting, contact us here.