Simplifying OTC derivative reporting of PPAs

Financial Power Purchase Agreements (FPPAs) are emerging as a great way for renewable producers to finance new projects. They also provide corporate off-takers the ability to participate in meeting their sustainable net-zero carbon goals.

Unlike traditional PPAs signed between renewable producers and utility firm off-takers with physical delivery of electricity, FPPAs operate as a derivative transaction that is cash settled. The result is that a FPPA is defined as a bilateral over the counter (OTC) derivative trade and falls under scope for derivative regulation such as EMIR in the EU & UK, Dodd-Frank (CFTC) in the U.S and ASIC in Australia.

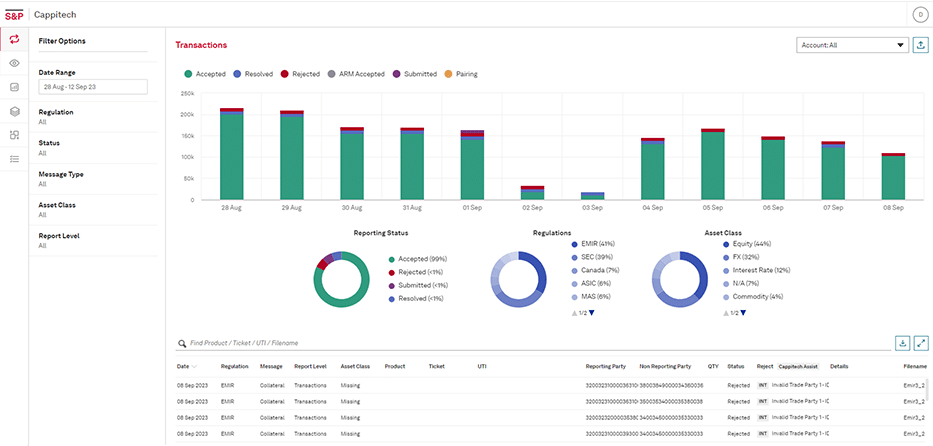

As leaders in OTC transaction reporting, with millions of transactions submitted daily, we have the expertise to report your FPPAs to regulators with a very quick turnaround.

How Cappitech can solve FPPA reporting obligations

What is PPA Reporting?

What is OTC Derivative Reporting?

OTC Derivative Reporting is a regulatory requirement across many countries including the US, UK, EU, Singapore, Australia and Japan. The regulation was created following the 2008/09 global financial crisis (GFC) as regulators across the globe wanted a framework to supervise exposure and risks of derivative transactions.

The regulation requires both financial and non-financial firms to report economic details and counterparties of their derivative transactions to a licensed trade repository. better understanding of a firm’s derivative exposure and their counterparties that could be affected in the event of insolvency.

How do FPPAs fall under derivative reporting regulation?

As a commodity derivative, FPPAs are under scope for most regulatory reporting regimes. Counterparties to a FPPA need to report in the jurisdiction they are based in. For example, a FPPA with a UK and US counterparty requires the UK firms to report under UK EMIR and the US firm reports according to CFTC Part 43 and 45 OTC reporting rules.

When is a FPPA reported?

FPPAs are reported after the execution time of the transaction. This is typically the period when contracts between the producer and off-taker are signed, and often can be well before the start date of electricity production.

The reporting deadline is T+1 for most jurisdictions with the exception being the US the US, that has a T+2 hours requirement and Singapore with its T+2 timeline.

Are daily valuations required to be reported?

As FPPAs are almost exclusively transacted between non-financial entities that fall below thresholds that require obligatory clearing, exemptions exist that remove obligations to report daily mark to market valuations of the transaction.

What are some of the difficulties reporting a FPPA?

As a new product, FPPAs fall under the commodity asset class but aren’t fully defined under existing value sets for OTC reporting regulation. Understanding definitions of both a PPA and OTC regulation are needed to correctly map transaction details to the submission fields.

Some of the questions that arise around FPPAs are whether they are classified as a commodity swap or CFD? How are notional amounts calculated? And how and when to report modifications due to changes in the parameters of price and energy production?

Learn More