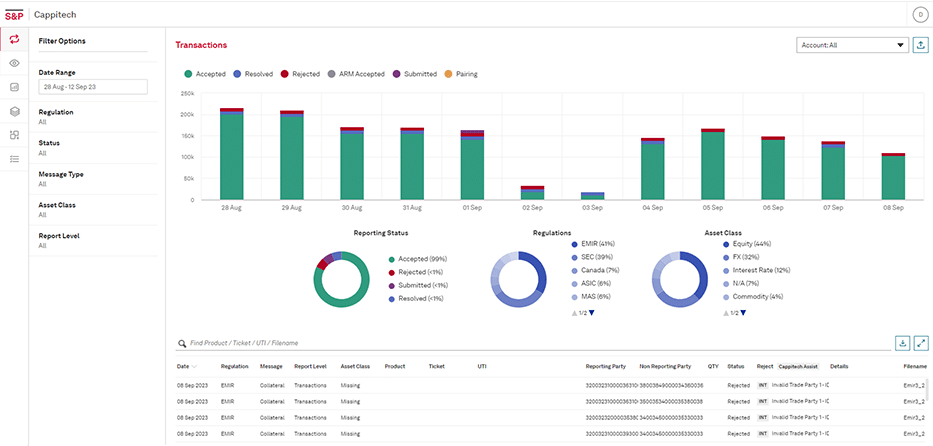

MAS OTC Reporting Solution

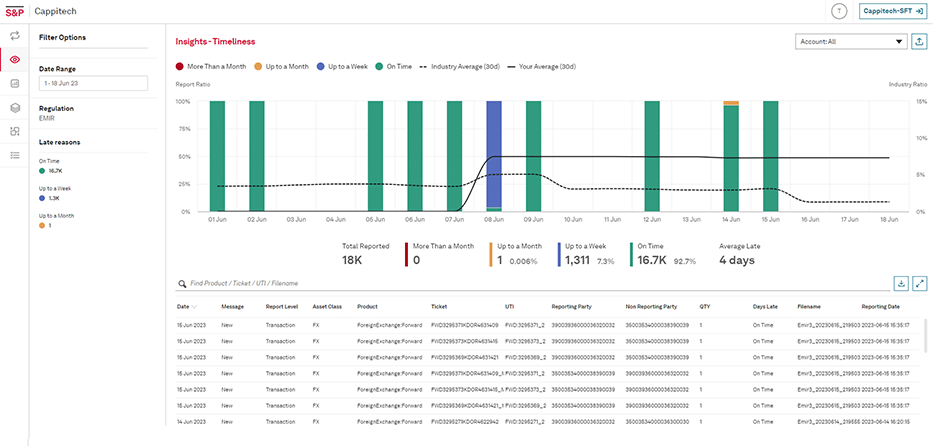

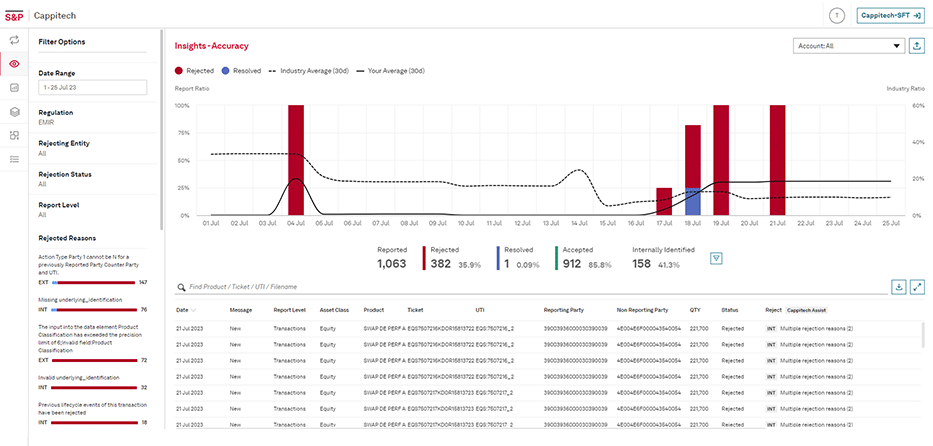

We keep you compliant with MAS regulation, allowing seamless, accurate daily compliance reporting and tracking. Investment firms, banks, asset managers and brokers rely on us to automate their transaction reporting and remain compliant without any headaches or human errors.

Singapore’s Monetary Authority of Singapore (MAS) created the Securities and Futures Reporting of Derivative Contracts Regulation under the Securities and Futures Act. Including all six items of Part IA of the First Schedule of the Regulation, and covers Interest Rate, Credit, Foreign Exchange, Equity and Commodity contracts. There are a lot of moving parts that need to be accurate, reported in a flawless, timely manner.

How Cappitech can solve your MAS OTC reporting obligations

What is MAS OTC Derivative Reporting?

The Monetary Authority of Singapore (MAS) created the Securities and Futures Reporting of Derivative Contracts Regulation. Updated in October 2018, the regulation covers OTC derivative trades for credit, FX, equity, commodities and interest rate contracts.

Who needs to report under MAS OTC Derivative Reporting?

As of October 2019, holders or Bank and Merchant Bank licenses, Significant Swap Holders and Capital Markets, Finance Company, Insurance and Subsidiary Bank license holders that meet certain trading or AUM thresholds fall under the regulation.

Where do you need to submit MAS OTC Derivative reports?

MAS OTC derivative reports are sent to designated trade repository (TR) which are regulated under MAS, and who manage and secure the data and make it available solely to regulators. Currently, DTCC is the only TR you can report to.

Under MAS Regulation are retails counterparties under scope?

Under scope for MAS are any OTC derivatives which include CFDs and FX. However, the regulation exempts trades with retail counterparties. This is important item for CFD brokers as it limits the number of trades they need to report or exempts them altogether. Worth noting is that the exemption doesn’t cover STP hedging of retail flow with intra-group entities or external entities. Therefore, STP brokers who are hedging over $SGD 5 billion in trades with an institutional entity are required to report those legs of the trade to the MAS.

Are there exemptions for ETD trades?

Yes, MAS regulation only requires OTC derivative trades to be reported with exchange traded derivatives (ETDs) exempt from the regulation.

Learn More