Activity Never Stops

New Regulations, New Services and New Industry Collaborations

With less than three months to go until the CFTC Rewrite deadline, we’re extremely pleased that most of our in-scope clients are well on track. Our UAT environment is live and connected to the DTCC, and clients already reporting under old requirements are ready for a simple switchover on 5 December. Both our team and our clients’ teams have worked hard to meet this milestone, proving yet again that forward planning and collaboration across clients, vendors and regulators can smooth the process of new regulations. Well done to all.

Of course, CFTC being complete won’t slow things down. We’re continuing to expand our offering to meet the needs of an ever-growing client base and a changing market. We’ve added a new End-of-Day Trade Repository Reconciliation feature that provides a daily output showing field by field comparison of the data held at the TR versus the data within our platform. This helps our clients conduct systematic reviews of their submissions, in line with regulators’ requirements. Furthermore, we have launched other exception management tools to handle tasks such as pairing and matching, eligibility and more.

We continue to value feedback from our clients and the market and are ensuring that services developed for one regime are, when appropriate, incorporated into other regulatory reporting requirements. Most recently, we’ve seen this with UTI Connect. Originally created as an enrichment and sharing tool for SFTR, we’re now bringing this powerful engine to EMIR. By connecting UTI generators and receivers, UTI Connect reduces UTI pairing breaks and makes it easier for reporting firms to correct and replace incorrect UTI details.

Collaborative processes are now baked into our approach and we’re proactively working with the industry ahead of the EMIR REFIT 29 April 2024 go-live date, including holding our first strategic design group meeting with customers in September and October. Existing EMIR customers are taking part in our Best Practice EMIR working groups as a way to review details of the REFIT, how it affects them and what their peers are doing.

Something else we’re excited about is the feedback on our managed services offering, providing assessment, implementation and managed services support. Increasingly it’s clear that our approach of going beyond technology is in high demand and this is just one example of how we’ll be doing this in the future.

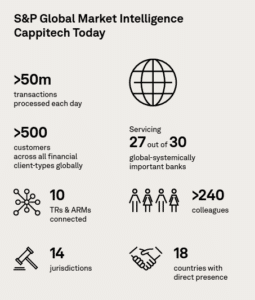

Finally, as we enter the last leg of the year, I feel humbled by what we have achieved over the last three years thanks to our leading-edge technology, our global coverage along with the local expertise of our 240+ fantastic colleagues, and our network of 550+ client partners. I look forward to what we will achieve over the next three years and beyond. As we deploy further advancements onto our platform, S&P Global Market Intelligence Cappitech remains as committed as ever to providing the best-in-class reporting solution in the market and will continue to set the industry standard for how market participants comply, monitor and perfect their regulatory reporting.

For the original piece as it appeared in our recent newsletter please download here.

For further information, please contact regreporting@spglobal.com