Key Takeaways from “The Future of Regulatory Compliance” New York Event

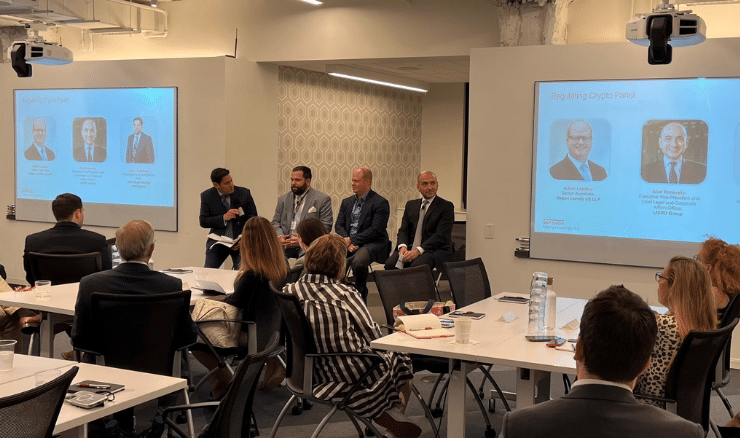

On June 14th, we hosted “The Future of Regulatory Compliance” client event in New York City. We welcomed clients and partners to hear from industry experts on key topics around:

1) the crypto regulatory framework in the U.S.

2) the regulatory reporting roadmap, challenges, what clients can do to stay ahead

3) the case for managed services to help clients resource, scale and reduce key person risk for business-critical tasks in their organizations.

We had panelists from OSTTRA, EY, ISDA, S&P, tZERO, Hogan Lovells, SEI and Align with a packed room of firms across sell-side, buy-side and partners to join in a very topical and engaging discussion.

The crypto regulatory outlook discussion was very timely as it coincided with the proposal of the Responsible Financial Innovation Act, better known as Lummis-Gillibrand bill. Overall, the view from the panelists was clear – practical regulation is needed to foster a healthy marketplace for these new asset classes while protecting investors.

Digital assets are a new asset class and technology. And as witnessed with other new and disruptive products/services, there will always be a lag between a technology revolution and regulatory framework development . However this will get resolved in short order in the U.S. with oversight from either the CFTC, SEC or both.

The regulatory reporting panel was insightful and interactive, with lots of questions and participation from the audience.

The pace of regulatory changes is picking up with significant rewrites/changes in the U.S., Canada, Europe, Australia, Singapore and Japan on the horizon. The industry is struggling to keep up with resources and costs. Great work has been done to standardize requirements/data formats through CPMI-IOSCO and ISDA, but still, a lot more needs to be done to help ease the burden on firms.

The managed services panel focused on stricter requirements from regulators, outsourcing, and the challenges firms face with resourcing regulatory initiatives/projects. Regulators are starting to ask clients to explain products and demonstrate the outsourced system they are using.

There is a strong move toward managed services as uncertainty within firms grows, and the need to keep up with regulatory change is here to stay.

We look forward to our next in-person compliance event, this time in Boston, on September 14th. For more details, contact regreporting@spglobal.com