Revised MiFID II/MiFIR texts are now EU Law: What do firms do next?

Historic news last week for firms impacted by EU-27 MiFID II/ MiFIR: after 3 years of review the European Council adopted revised rules designed to enhance the strength, resilience and ultimately the attractiveness of EU capital markets to both European and Global investors: MiFIR and MiFID II: Council adopts new rules to strengthen market data transparency – Consilium (europa.eu)

This latest milestone concerns the new Level 1 texts which are the primary legal instruments adopted by the 3 EU institutions: the Commission, Parliament and Council. These revised MiFID II/MiFIR texts entered into force on Monday 11 March when they were published in the Official Journal of the EU, and are law as of 28 March 2024.

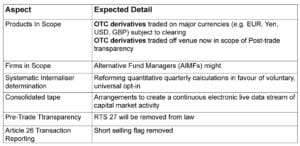

18 months after publication in the Official Journal – circa September 2025 – Member States must make these laws national and implement the administrative provisions to comply with 182 pages of new requirements. As for the changes themselves, the granular detail will be the subject of a separate Cappitech blog, a brief summary of Transaction Reporting and Post-Trade Transparency Rules are:

At this stage firms would normally take the Council’s adoption of the new rules as a trigger for planning their book of work with all necessary resources and budget for what looks like a Q3 2025 go live milestone for compliance. However the task is complicated by a lack of clarity regarding the timetable for publication of the necessary Level 2 texts, the detailed technical standards, schemas, rules, and guidelines which underpin the systemic implementation across all industry players. In the hierarchy of EU regulation, the Level 1 law does not afford firms, service providers, nor National Competent Authorities (NCAs) sufficient granular detail to adapt industry systems to the new MiFID II/MiFIR. But all market participants are aware that they are obliged to adhere to them once they are law imminently.

The current question various industry discussions groups are focused on is: how do I comply with a legal Level 1 requirement without the necessary technical standards? The scenarios of what could happen next could range from, a) A potential delay of the entry into force of the Level 1, b) implementation of the Level 1 on time as best as possible, then subsequently a Level 2 implementation after these details are published, or c) Might ESMA issue a ‘no action’ letter to NCAs while the industry consults and responds on the several technical standards required.

The market expects further notifications from the direction of ESMA in the form of consultation papers leading to revised MiFID II/MiFIR RTSs during Q2/Q3 2024 and perhaps also a statement regarding the Level 1 go live date to resolve the legal uncertainty. It is important for firms to closely monitor the progress of legislative proposals and stay informed about their obligations under amended EU capital markets regulations. Cappitech will issue further blogs as events develop.

Learn more about how Cappitech can help with your MiFID II/MiFIR reporting, or contact us here