UK vs. EU MiFID II Transparency Amendments: What’s Changing and What It Means for You

The regulatory landscape for MiFID II APA reporting is evolving, with both the UK and EU introducing amendments that impact transparency, data fields, and reporting requirements. While these changes share the common goal of enhancing market transparency, there are important differences every compliance team should understand. Here, we break down the key distinctions between the UK and EU amendments, so you can stay compliant and make informed decisions.

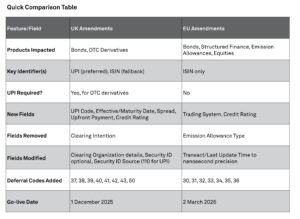

- Products Impacted

UK Amendments (Effective 1 December 2025):

- Bonds

- OTC Derivatives

EU Amendments (Effective 2 March 2026):

- Bonds

- Structured Finance Products

- Emission Allowances

- Equities

Key Difference:

The UK amendments include OTC derivatives, while the EU amendments specifically exclude them.

- Instrument Identifiers: UPI vs. ISIN

UK:

- UPI (Unique Product Identifier) is now the preferred identifier for OTC derivatives.

- ISIN is used only if UPI is not available.

- Do not report both UPI and ISIN for the same trade.

- For bonds, ISIN remains relevant unless a UPI exists for derivatives.

EU:

- ISIN is the only accepted identifier for all products covered (bonds, structured finance, emission allowances, equities).

- UPI is not included since OTC derivatives are not part of the EU amendments.

- New Fields Added

UK:

- UPI Code

- Effective date of the contract

- Maturity date of the contract

- Spread

- Upfront Payment

- Credit Rating

EU:

- Trading System

- Credit Rating

- Fields Removed

UK:

- Clearing Intention

EU:

- Emission Allowance Type

- Fields Modified

UK:

- Clearing Organization details must now be reported. This means the Root Party ID, Root Party ID Source, and Root Party Role fields will reflect clearing organization details.

- Security ID is now optional for UK derivatives, as UPI can be reported.

- Security ID Source field now supports code 110 to accommodate UPI.

EU:

- Transact Time and Last Update Time must be reported to nanosecond precision, aligning with the regulatory obligation of the reporting firm.

- Change in Deferral Codes

UK:

- New deferral codes added: 37, 38, 39, 40, 41, 42, 43, 50

EU:

- New deferral codes added: 30, 31, 32, 33, 34, 35, 36

- What’s down the line?

On December 15th, 2025, ESMA issued RTS 2 Final Report of changes (Link). As ESMA aims to bring forward a consolidated tape of transaction data, the Final Report creates further RTS 2 APA Transparency Reporting changes to help achieve their consolidated tape goals.

- How Cappitech Helps You Navigate These Changes

Cappitech’s platform automatically:

- Identifies which transparency regime (UK or EU) applies to each trade.

- Applies the necessary validations and enrichments based on the specific regime.

- Ensures you’re always reporting the correct fields, in the correct format, to the correct regulator.

You can choose to let Cappitech perform the eligibility check for you, or do it yourself—whichever suits your compliance workflow.

Final Thoughts

The UK and EU transparency amendments share the goal of improving market reporting but differ in scope, identifiers, and technical requirements. By understanding these distinctions and leveraging Cappitech’s automated regime identification and validation tools, you can ensure seamless, compliant APA reporting—no matter where your trades take place.

Have questions?

Contact Cappitech’s regulatory experts today here to discuss how these changes impact your reporting and how we can help you stay compliant.