March trading volatility, rising volumes, cross-asset benefits and risk management

Declines in global stock markets during March led indexes to record losses. In the US, the Dow Jones had it’s worst ever start to a year, falling 23.2% for Q1. However, the stock price declines and market volatility that include single day losses and gains of over 10%, also triggered surging trading volumes.

Benefiting from the volatility were retail and institutional brokers. Many of them set record single day and monthly trading volume records. To better understand the volume increases, Cappitech analyzed client transaction report statistics from their overall customer based as well as focused on broker results.

The data included information from investment firms using Cappitech’s compliance reporting technology to submit reports EMIR, MiFIR and other global transaction reporting regimes and covered nearly a quarter billion new trades executed in Q1 2020. The statistics revealed a number of interesting findings and greatly supported the importance of having a wide-variety of available products.

Headline figures**

March transaction numbers rose 113% vs February

Q1 2020 rose 130% vs Q4 2019

March 2020 volumes rose 245% compared to Q4 2019 monthly average

**Composite volumes of Cappitech customers including brokers, banks and asset managers

Equities lead asset manager volume growth

Not surprisingly, transactions of equities saw the largest spike in volumes. Asset Managers with a large weighting on stocks experienced high turnovers during March. Overall weighted average of Asset Managers showed a 141% increase of transactions in March compared to February, with one firm reporting a 500% increase in volumes.

Fixed income trading spurs prop trading increase

Among prop trading firms, volumes in Fixed Income Interest Rate futures and options surged in March, with one company seeing an over 350% increase of transactions compared to February. Overall, prop trading firm volumes more than doubled as they rose 118% in Q1 compared to Q4 2019. The volume increase was a welcome change as a number of firms cited stagnant volatility to end 2019 dragging down their trading.

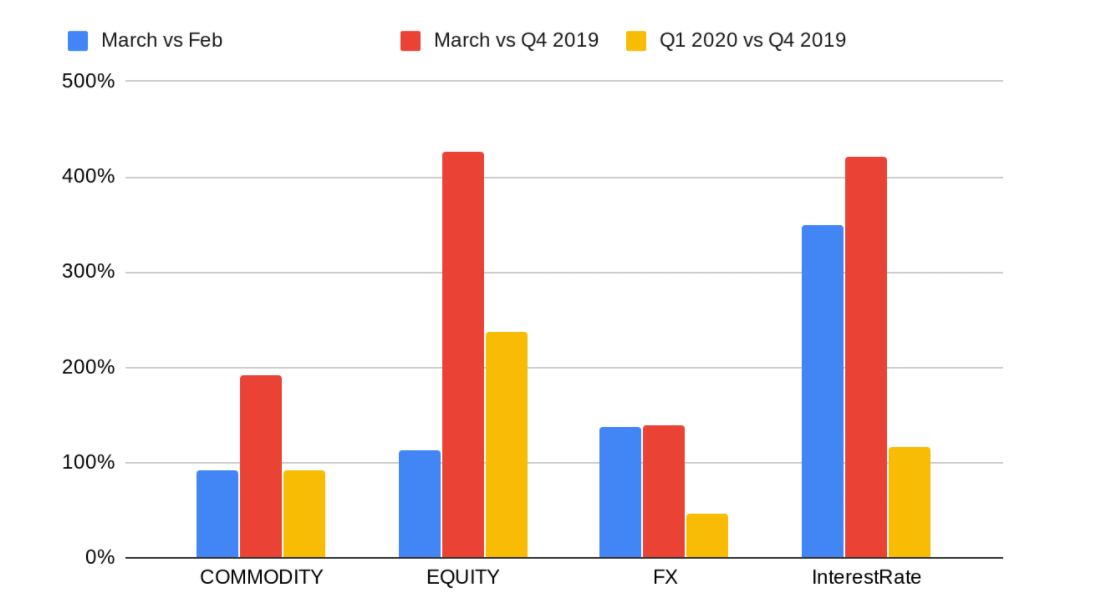

Viewing overall derivative statistics from all Cappitech clients during the quarter, transaction growth during March for Interest Rate products (includes Swaps, Options, Futures, CFDs and Forwards), rose 421% compared to Q4 2019 averages. The figures only trailed Equity derivatives for the most active volume gainers during the quarter.

CFD Broker breakdown

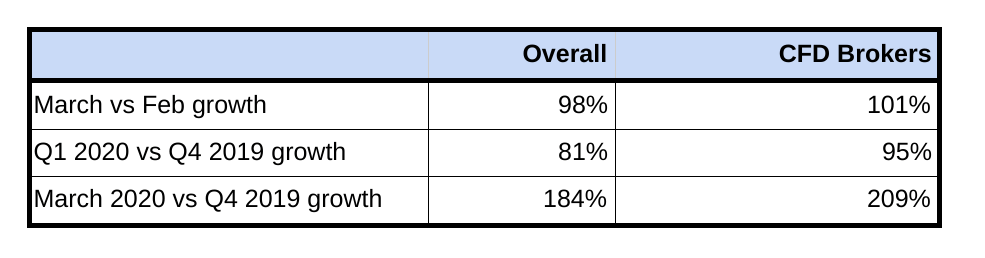

Focusing on statistics of just under 50 EU based CFD brokers (retail & institutional) showed the importance of having a multi-asset offering. Using a weighted average of investment firm transactions, overall broker volumes were similar to that of Cappitech’s customer base that was analyzed, with slight increases for brokers.

Multi-asset advantage

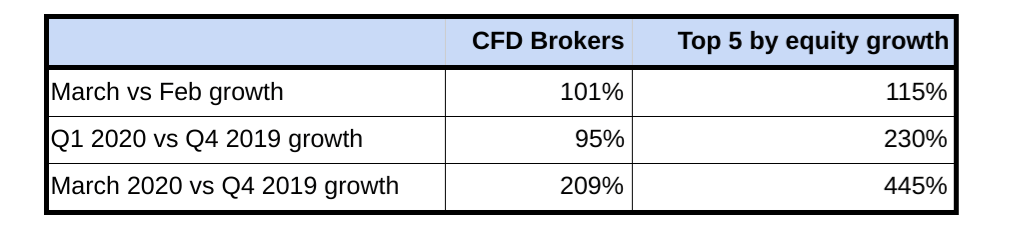

Not surprisingly, brokers that had a strong March of equity volumes, outperformed their peers during the quarter (equity volumes include CFD trades of single stocks and equity indexes). Reviewing statistics for top five brokers by quarterly increase of equity volumes showed a greater than 50% outperformance of Q1 vs Q4 growth compared to their peers (230% vs 95%).

Interestingly, among the brokers with the strongest Q1 equity growth, increases in transaction volumes began to be seen in January and February. While for laggards, their equity volume increase primarily took place during the volatile March period.

There may be a number of factors that led to this phenomenon, such as laggards offering a limited amount of equity trading products. The data shows that firms that have promoted equity products compared to focusing on FX and metals, were in a better position to capture increased volumes in the Q1 period. Overall, the figures support the argument that CFD brokers benefit in volatile markets with a wide ranging cross-asset offering.

Risk vs Reward

While the market volatility was welcome among brokers and prop trading firms, it did come with risks. In discussions with clients, they mentioned that the wild stock price swings increased the need to have in place strict risk management monitoring. This became more difficult with many compliance and back-office staff related to the trading department working from home due to the current Covid-19 pandemic

Looking for an easy-to-use, global reporting platform? Cappitech has the answer.