Cappitech launches ‘Insights’ tool for peer review regulatory analysis

With MIFID II now over a year old, the focus has moved from mere ‘compliance’ to ‘improving the data quality’ of submitted reports. Heading into 2018, most EU firms were under pressure to comply with all the new facets of MiFID II. Therefore, their goal was to have systems in place to comply with the new laws when they went into effect on January 2018.

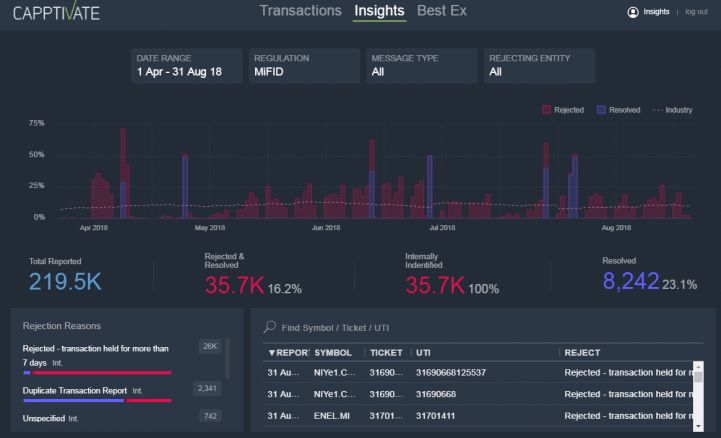

To help financial firms improve data quality of their reporting, Cappitech has launched the new Insights product as part of our multi-regulation reporting dashboard. The tool provides granular statistics on rejection reasons and late reports. across MIFIR, EMIR, MAS, Canadian and ASIC Derivative Reporting.

Focus on KPIs

At Cappitech, we believe the best way to improve regulatory reporting is to set Compliance KPIs. With Insights, financial firms have actionable data and analytics they can use to gauge the quality of their reports, identify areas that need to be addressed and monitor improvement over time.

As an example, Insights tracks the percentage of rejected reports per day and top submission errors. The information allows firms to identify whether there is a systematic problem such as handling ISIN details, client identifiers (NCIs) or venue information. By flagging the major problems, Insights allows firms to quickly improve their submissions.

At-a-glance charting of rejection rates enables compliance teams to improve their reporting over time. In addition, the performance data can be used to set internal KPIs.

Peer Review

A common question we get from our customers is: “How does my reporting compare to the rest of the market?”. To address this, the new Insights and performance product also provides peer review statistics.

Combining anonymized data from across the industry, a rolling percentage of Rejection and Late Report rates across each regulation is available for Cappitech customers to compare to their performance statistics. In this way, firms can understand if they are lagging or outperforming their peers in terms of the quality of their submissions.

History of market leading compliance technology

When we first launched our Regulatory Dashboard in early 2016, our goal was to create the industry’s leading reporting portal. The dashboard would need to support multiple regulatory jurisdictions, be fully automated and offer transparent, granular data and analytics.

From initially only supporting EMIR, the Dashboard has quickly grown to include MIFIR, EMIR, ASIC, MAS, Canadian derivative reporting and Best Execution monitoring – all on a single platform.

With Insights we have added next-generation features to give compliance teams the tools they need to monitor and improve their regulatory reports. Features include:

- List of top rejection reasons

- Whether rejections were identified by internal validation or the NCA

- Filters by regulation, rejection type and date

- At-a-glance charting of rejection and late report rates versus the industry average

In the future, Insights will grow to include other key data points to help your firm. In the pipeline are analytics of counterparty transaction percentages and leaderboards of top traded products by volume.

To learn more about how Cappitech Insights can help you improve your reporting qualtiy and compliance KPIs, download our brochure.