ESMA releases 4th Annual EMIR, SFTR and MIFIR Data Quality Report

The European Securities and Market Authority (ESMA) issued their 4th annual data quality report earlier this month. The report covers 2023 data across EMIR, SFTR and MIFIR transaction reporting regulation.

The annual review provides a glimpse at areas of focus for ESMA, and often foretells issues that European National Competent Authorities (NCAs) will be contacting reporting entities about. An example was the 2021 report which highlighted high numbers of open EMIR transactions and positions of which mark to market valuations weren’t being updated. This prompted many NCAs to communicate the valuation issue directly with financial companies. The coordination between ESMA and NCAs was noted in last year’s annual report as being responsible to improve overall data quality of valuation details for open transactions and positions.

This year, ESMA explained their data strategy for 2023 to 2028. The strategy is based on four main objectives; providing enhanced data to NCAs, making more of its market data available to the public, promoting data-driven supervision and improving their data platform to allow for faster processing of information. The enhanced data strategy furthers rhetoric from last year of which ESMA stated that they were working on providing dashboards for NCAs to improve their supervision work. In 2023, ESMA also highlighted that they had started a program to review submitted reports for anomalies.

Elsewhere, these are a number of other areas of focus and theme from this year’s report.

Pairing & Matching Details

Last year we noted that after the first two annual reports being focused on unique trading identifier (UTI) matching breaks between counterparties of their EMIR and SFTR submissions, there was no mention of the matter. This year’s report continued that trend of not including details on the percentage of EMIR and SFTR submissions where UTIs weren’t paired. In replace, ESMA brought examples of economic fields where counterparties are reporting different data such as incorrect notional amounts under EMIR and Loan Values for SFTR.

Anomalies Update

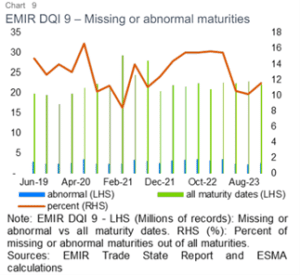

Last year’s report included mention that ESMA had begun to focus on abnormal values being submitted as a way to flag incorrect EMIR and SFTR reports. The review consists of creating a list of expected numerical and date ranges for different fields and filtering for data out of those tolerances. ESMA provided full year findings in the data quality of their analysis.

One specific example highlighted are maturity dates where ESMA scanned for submissions where the date exceeded 51 years from the transaction of the derivative or didn’t include a value. As per the chart below, 10-16% of trades were flagged by the anomaly review with no showing of improvement. According to ESMA, they will continue to monitor the results and if no improvement takes place, they will collaborate with NCAs to follow up with reporting entities.

Elsewhere, ESMA related that they are conducting machine learning analysis of MIFIR transaction reporting submissions. While the report didn’t highlight any specific examples of anomalies, it did reveal that their analysis had uncovered a number of misreporting cases by reporting entities and that they are collaborating with NCAs on remediation policies.

Timely Valuations

Despite improvements, ESMA continues to be monitoring for timely valuations of EMIR submissions. These cases where an updated mark to market valuation hasn’t been submitted for open reports. They can occur when a financial entity omits sending a daily valuation update, or hasn’t send a termination message for a position when it is closed. After peaking above of total outstanding positions 30% in April 2020, the figure dropped to 12.2% by December 2023. According to ESMA, NCAs reached out to 73 counterparties about missing valuations which led to improvements in data quality.

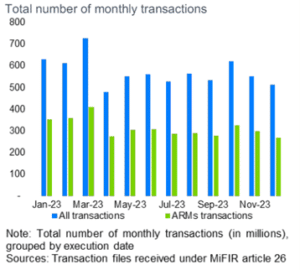

ARM vs NCA MIFIR Submissions

A new part of the report is ESMA’s review of MIFIR submissions and the market share of trades reported through an Approved Reporting Mechanism (ARM) versus trades submitted directly to a NCA. According to ESMA, the total number of submissions via an ARM rose in 2023 to 54.6 from 53.1% in 2022 with two ARMs accounted for over 90% of submissions (see chart above).