Preparing For EMIR REFIT – More variety in the Collateralization field

Continuing in our monthly EMIR REFIT preparation blog, today we take a look at changes arriving to the collateralisation field. On the surface, the collateralisation field should be fairly straightforward. But experience has shown that it’s often not as simple as it appears with different variations of how margin and collateral is held and sent between firms.

Collateral and margin were an area of interest in March 2021 when new validation rules to EMIR included a number of changes to the conditional formatting of the fields (more about those changes). Specifically, ESMA aimed to increase the scope of firms reporting margin details that had been optional in many instances. However, the current format does limit disclosed margin details in cases such as in one-way margin posting.

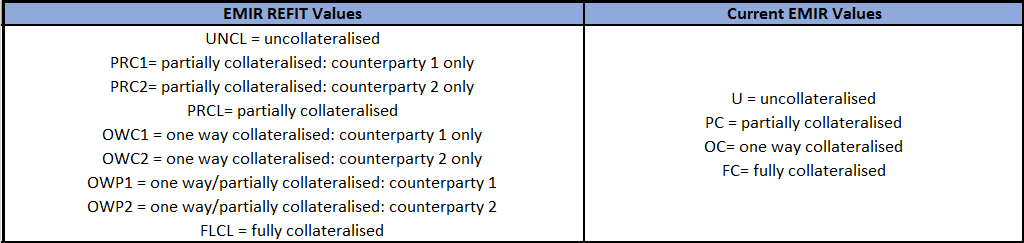

As a result, the EMIR REFIT and technical standards add new values that can be reported in the collateralisation field. The formula follows guidance from industry working groups that are building Common Data Elements (CDE) standards for derivative transactions.

As seen in the table above, the CDE values aim to provide further clarity on how to define the counterparty posting margin in one way collateralised scenarios. The REFIT also allows for situations where each counterparty posts collateral differently.

Overall the REFIT update departs from the current formula where collateralisation definitions are based on the point of view of the reporting party and may not take into account whether margin does exist with the transaction.

Read all our EMIR Preparing Post: