Common errors along with new ones persist under MIFID II Reporting

Over the summer, the UK FCA published their periodical transaction reporting report, Market Watch 74 (link). The report, along with ESMA’s yearly reviews (link) is a must read for those involved in regulatory reporting as it provides details on financial regulators and reviewing data submitted to them.

Like previous editions, Market Watch 74 has a MIFID II focus which may currently be overlooked in the UK and EU as many firms are prioritizing EMIR REFIT readiness ahead of the 2024 go-live dates. With the summer concluding and staff returning to the office, it is a good time to review items being flagged now by the FCA along with other MIFID II reporting issues that are often raised and continue to be present in submissions.

Reconciliation

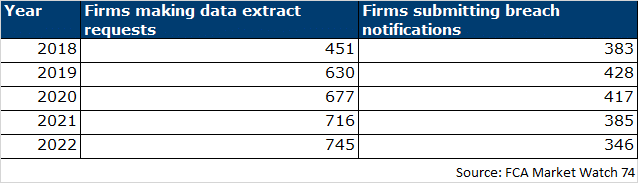

An ongoing item raised by the FCA since MIFID II went live is the requirement for firms to reconcile submissions made to FCA to their books and records. This is done by downloading a XML data extract from the FCA Market Data Portal (MDP) and comparing to ARM submissions and books and records of reportable transactions. As discussed in past blogs (link), the FCA tracks the number of firms that are downloading data from the MDP and contacting many companies that aren’t. According to the FCA, the number of firms using the MDP continues to increase, reaching 745 companies in 2022 compared to 451 in 2018 (see table below).

Breach Notifications and the Five Years of MIFID II

As part of the EMIR REFIT, ESMA and the FCA have provided clearer guidelines on how firms should review for data quality issues and notify NCAs of omissions and errors (learn more). For MIFID II, many NCAs have also contacted reporting firms on data quality issues they have found as well as directing them to submit error notification reports.

With MIFID II now reaching over five years since its inception, it has triggered the question of how to handle corrections and submissions of trades over five years old as they fail validation rule 269. On this point, the FCA stated that they don’t expect firms to cancel and rereport trades over five years old, but that they do expect an error notification to be submitted to them. As part of their monitoring, the FCA related that they track the number of firms submitting breach notifications (see table above) with the number gradually falling since peaking in 2019. This may be the result of improved reporting quality as MIFID II requirements are better understood.

Investment and Execution Decision Maker

Among the reporting fields highlighted by Market Watch 74 are the Investment and Execution Decision Maker within firm (fields 57 and 59). According to the FCA, they have found various formats of how firms attributing the execution and investment decisions such as to specific persons, client names or algorithms. The FCA specifically mentioned that in cases where there was an individual directly related to the transaction they should be named and not a senior manager with limited influence on trade level decisions.

Depending on the trading capacity of the reporting firm, different validations are applicable to how fields 57 and 59 are entered. Cappitech has also encountered inconsistencies of how firms are reporting these fields, that often are the result of applying the same logic to trades with different trading capacities.

Identifying Buyer and Seller

Another common error that had affected many reporting firms in the early period of MIFID II reporting was the identification of who is the Buyer and Seller of the trade. In cases where a trading capacity is reporting as Match (MTCH) or Any other Trading Capacity (AOTC), they are transmitting an order and appear as the Execution Entity buy aren’t a Buyer or Seller of the trade. The common example is a Fund Manager Executing Entity of which fills a trade for their fund client at a broker or bank who are the Buyer and Seller of the transaction.

The FCA stated that it was continuing to see errors in relation to reporting the correct Buyer and Seller, specifically in cases of ‘chains’ where multiple legs of a trade are being reported.

Counterparty Comparisons

An interesting takeaway of the Market Watch is that the FCA mentioned that they are reviewing inconsistencies of how different counterparties are reporting similar products. Their example was in relation to price and quantity of Credit Default Swaps (CDS) and Equity products where both price and basis point notations were listed.

While counterparty pairing and matching doesn’t exist in MIFID II like it does in EMIR, firms are urged to conform reports to industry standards of how various products are booked and defined.

Product and Economic Details

Other items flagged by the Market Watch were product and economic fields. Over the years, the the FCA and other NCAs have been known to contact firms about various common errors including:

- Price: Incorrect prices that don’t take into account price multipliers of minor to major currencies such as UK equities that are quoted in pence but need to be reported in pounds.

- CFI Codes: Use of CFI codes that don’t match product descriptions or defaulting to entering only the first two letters of a CFI with the remaining characters entered as XXXX. Also occurring are options using default codes that don’t differentiate between a Put and a Call.

- Timestamps: Firms have been contacted about consistent reporting of timestamps that don’t consider seconds.

For more information on other common MIFID II errors to check along with details on Cappitech’s reconciliation solutions, please Contact Us