SEC Adopts New Rule to Increase Transparency in the Securities Lending Market

Almost two years after the publication of the 10c-1 proposal for the reporting of securities lending transactions, on Friday October 13th the Securities and Exchange Commission (SEC) voted to adopt the final rules. The Cappitech team is still digesting the 353-page document published and will provide additional insight into the requirements over the coming weeks.

As part of the G20 mandate to increase transparency in capital markets the main financial jurisdictions around the world have instituted rules to require the disclosure/reporting of various types of financial instruments including Securities Finance Transactions (SFTs), and securities, fixed income and derivatives.

Although there is already a lot of transparency with intraday, transaction level information provided by multiple vendors to the institutional buyside and sellside market participants, the Gamestop saga combined with the successful implementation of the European Securities Finance Transaction Reporting regime in 2020 (SFTR) has most likely accelerated the SEC regulatory agenda for SFTs.

Overall, there are some key provisions that are different to the initial proposal which are positive for the industry, but the requirement still poses a significant challenge given the other regulatory demands on many customers.

Who must report under Rule 10c-1?

Rule 10c-1 mandates reporting to Financial Industry Regulatory Authority (FINRA) by individuals falling under the category of “covered persons,” which includes:

(1) Lending Agent

(2) Lender

(3) a broker or dealer when borrowing fully paid or excess margin securities

Additionally, firms have the option to enlist a Reporting Agent (broker, dealer or clearing agency) or utilize a third-party technology provider to fulfill their reporting obligations to FINRA.

What needs to be reported?

Rule 10c-1 requires the reporting of securities loans on a reportable security, which includes any security that is currently subject to reporting under Consolidated Audit Trail (CAT), Trade Reporting and Compliance Engine (TRACE), and Municipal Securities Rulemaking Board Real Time Reporting System (MSRB RTRS), provided that they are neither centrally cleared nor used as margin by broker/dealers.

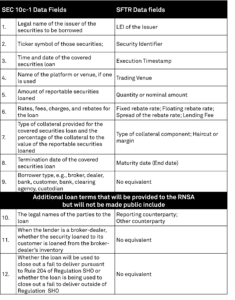

This entails the reporting of 12 specific data fields.

Where should the report be submitted to?

Details regarding securities loans are reported to a Registered National Securities association (RNSA), with FINRA serving as the specific RNSA in this instance.

FINRA also has the obligation to provide aggregate information to the general public on a T+1 basis. Additionally, FINRA is also required to report transaction level information 20 days after trade date (T+20).

Why was the SEC 10c-1 required?

Proposed Rule 10c-1 was designed to provide investors and other market participants with access to pricing and other material information regarding securities lending transactions in a timely manner. Regulators viewed the securities lending market as opaque and under the mandate provided under the Dodd-Frank Act, it was their obligation to institute rules to provide transparency in this market.

When should the SEC 10c-1 reports be submitted?

Reports must be submitted by the end of the day when the loan is executed, including new loans, modifications, and the necessary confidential information.

How should the reports be submitted to FINRA?

Details of the technical requirements have not been published and will need to be provided by FINRA no later than 4 months after the final rules are published in the federal register.

What are the differences between SEC 10c-1 and SFTR?

- A single sided reporting regime, instead of the dual-reporting requirement under SFTR.

- EOD/T+0 submissions, instead of a T+1 requirement

- Submissions to FINRA, instead of a trade repository.

- Products currently reported under CAT, TRACE & MSRB RTRS

- A limited number of data fields (12) will be reported for 10c-1, compared with 155 data fields under SFTR.

- ISO 20022 XML standards exist for SFTR, but the data standards are currently unknown for 10c-1.

Important timelines:

What’s next?

Cappitech will assist the securities finance industry with their SEC 10c-1 reporting obligations leveraging on existing SFTR integrations and reporting pedigree to enable our customers and their counterparts to meet the necessary requirements in a cost-efficient way.

Please note that we will be publishing a series of articles/blogs discussing the requirements, how they stack up against the existing SFTR requirements in the EU and UK and how firms can solve for these reporting requirements over the coming months. Below is a preview of some upcoming events where will be discussing the implications of SEC 10c-1.

- Cappitech SFTR Customer Forum-November 2nd, 2023 (virtual event) – All Cappitech SFTR customers are cordially invited to this event, if you have yet to receive registration link, please reach out to your account manager.

- Securities Finance Technology Symposium – November 21st, 2023 in London (in person event)

For more information about how we can help you prepare for the SEC 10C-1, please contact us here.