EMIR REFIT RTS Final Report Reveals Changes in Store for the Regulation

Earlier this month, ESMA published their Final Report on Technical Standards (RTS and ITS) for EMIR REFIT. The report is a culmination of updates to EMIR that were initially proposed in a Consultation Paper by ESMA in March. The Final Report now moves to the European Commission (EC) where it will be debated. Once published by the Commission and published in the Official Journal, it triggers an 18 month period to going live.

Effectively being called by many as EMIR Level 3, the Final Report adds a host of changes to the regulation. According to ESMA, the update is meant to align EMIR with agreed upon global standards and improve data quality. The coming changes were discussed last month in Cappitech’s webinar titled EMIR Present & Future which was presented along with REGIS-TR.

Key changes to EMIR

ISO 20022 XML Format -Among the items being addressed during the webinar was the alignment of many EMIR standards to that of SFTR. When it went live in July, SFTR put in place the obligation of submissions to trade repositories (TR) as well as TR to TR and TR to NCA messages to be in the ISO 20022 XML format. As part of the Level 3 update, XML submissions will become required for EMIR. This replaces current availability of investment firms and corporates to submit EMIR reports to TRs in CSV files. (For Cappitech customers, the CSV to XML conversion process will be added as a core feature under EMIR, similar to that of SFTR)

Global standards harmonization – The timeline for EMIR Level 3 implementation and late 2022 expected go-live aligns similarly with that of the CFTC Part 43 and 45 updates. While EMIR changes aren’t as drastic to those of the CFTC, they both have in common their goal to align report a number of report fields to global standards. Like the CFTC, ESMA is adopting standards promoted by CPMI-IOSCO for defining the logic structure of Unique Trade Identifiers (UTIs), Unique Product Identifiers (UPI) and other trade and instrument definitions.

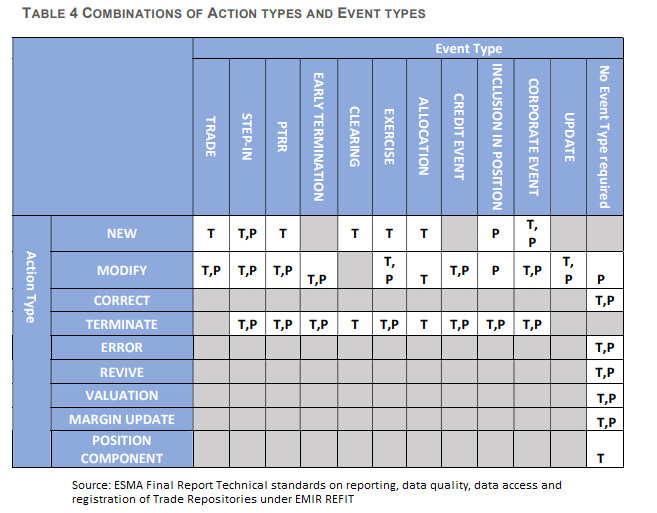

Change to lifecycle definitions – Currently, EMIR reports are based on lifecycle events being defined by their Action Type. Included are New, Cancellation, Compression and Termination of positions. To provide more granularity, the EMIR REFIT is adding another component to lifecycles, the Event Type. With the change, 10 Event Types are being added to the current 8 Action Types. The event types describe more details of the underlying action and include events of a Corporate Event, Exercise, Allocation and Early Termination. Each Action Type has specific Events that can be applied to it (see combination table below).

Removal of fields – While much of the REFIT focuses on additional information, there are a number of fields being removed. Examples are the Trading Capacity and Beneficiary ID fields which weren’t found to provide much value.

Alignment with how products are transacted – One of the challenges of any Transaction Reporting regime is avoiding a ‘one size fits all’ legislation that doesn’t cater to differences in product types and asset classes. EMIR currently supports many different report scenarios based on asset class, instrument and product type. However, there remain times when reporting fields don’t match standards of how products are booked within internal transaction systems. To improve this, the Consultation Paper included questions on best formats for defining the ‘Direction’ field and standardizing which products can fall within Position Reporting. The result are new standards to a number of existing fields that take into account feedback of how various products are actually traded and accounted for.

Crypto reporting – Following on the theme of adapting EMIR fields to existing derivative products being traded, EMIR Level 3 will better support crypto-assets. While crypto derivatives are MIFID products and would fall under EMIR as a derivative, certain characteristics made them difficult to report. Specifically, without approved ISO currency codes for bitcoin or other cryptocurrencies they can’t be reported under the FX asset class. This has caused many to report them under the commodity asset class but without a clear definition of what they are. To remedy this problem, the REFIT has created a new field called ‘Derivative based on crypto-assets’ to identify crypto based transactions. According to ESMA, the identifier helps regulators in understanding volumes and risks of crypto asset derivatives.

Beyond the changes above, the REFIT brings many additional fields that investment firms will need to map to. Once implemented, EMIR reporting will grow to around 200 available data fields. While no single transaction encompasses all of these fields, each current submission type under EMIR will become more complex under Level 3.