What Regulators do with your MiFID II data, EMIR Changes and Compliance Updates

MiFID II has hit the half year mark, which means regulators now have six months of data to look at. To delve deeper as to what ESMA and local National Competent Authorities (NCAs) are doing with the data and how they are supervising MiFID II, Cappitech recently organized a Working Group morning for Compliance Officers. The event was hosted by Duff & Phelps, a global regulatory consultancy firm, in their London office at The Shard.

The goal of the morning was to gain an update of on MiFID II reporting, learn about FCA feedback, discuss potential EMIR changes and look towards other regulation that compliance professionals should have their eyes on. Along with insights and answer to questions from Duff & Phelps, attendees provided their own feedback and experiences in the open forum.

Below are some of the key takeaways from the morning.

What is the FCA and ESMA looking for in MiFID II data?

With so much data collected by regulators, a question Cappitech often receives is “do the regulators even look at the data?”. The Working Group provided an opportunity to get answers to that questions as Duff & Phelps staff includes professionals with previous experience working at the FCA, Bank of England and Trade Repositories. Among the experience included being initial employees of the FCA’s Market Reporting Team and being on the ground floor of the regulator using MiFID I transaction reporting data for its monitoring.

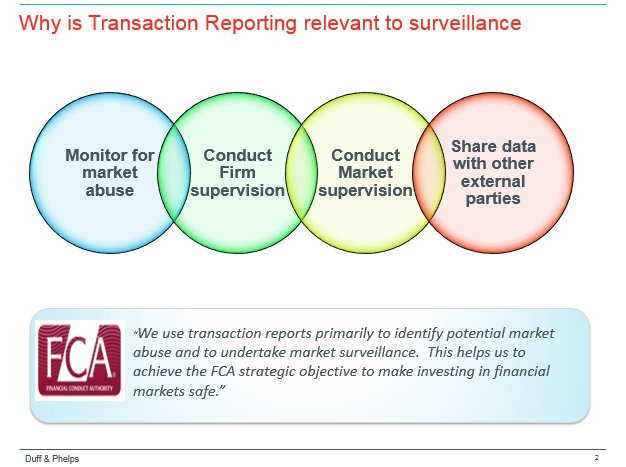

According to Duff & Phelps, regulators use the reporting data to supervise for four main items; monitor for market abuse, conduct firm supervision, conduct market supervision and sharing data with external parties. The market abuse monitoring and market supervision is done on both a macro and micro level; looking at both larger scale trends and trading patterns of individual traders and firms.

In regards to detecting bad behaviors among investment firms, it was noted that in their experience working with the FCA, they had used transaction reporting data submitted by investment firms to detect churning of client portfolios, front running of client orders, large scale frauds, excessive intra-day ‘Principal’ positions and many other offences and new trends in the market.

Separately, regulators use the wide reaching data from trading venues for market supervisions and to spot abuse. Using the data, along with market surveillance systems in place by exchanges, regulators can review for insider trading and price manipulation.

Source: Duff & Phelps

Despite the focus on venues and their data to spot market abuse, brokers are also expected to play a role. With transaction reporting information collected, regulators can see when a single trader or institution is trading the same stock or asset type across various brokers. Therefore, what may appear like a lucky trade to a single broker could be an insider trading pattern seen by regulators when viewing all of someone’s trades across numerous brokers.

Broker attendees at the event explained that they had been contacted at various times to provide additional information for commodity and stock trades due to market abuse suspicions of specific clients. Brokers were also advised to be proactive in reporting suspicious behavior. As such, if a firm believed that one of their clients is abusing the market, they should inform the FCA or other local regulator instead of waiting to be contacted.

Firm Supervision and having contact with the regulator

The direct connection between the FCA and investment firm is part of the regulator’s ‘Firm Supervision’. Along with using transaction reporting data to monitor the overall market and specific cases of market abuse, Duff & Phelps described that the information is also used to understand an individual firm’s business and evaluate their trading scenarios and risk control frameworks.

Cappitech/Duff & Phelps Compliance Working Group

It was also noted that the FCA keeps track of firms that report to them their periodic findings. This includes notifying the FCA of temporary reporting breaches that can take place when adding launching new products, updating a database updates or conducting a periodic review and realizing a small reporting error took place. In addition, the FCA reviews how often investment firms download MiFIR data that is submitted to them by ARMs on their behalf.

Overall, it was stated that “the FCA likes to hear from its brokers”. Therefore, firms that have limited correspondence with them, may be targeted for reviews.

What’s new with EMIR?

With MIFID II in effect, it seems like EMIR is ‘so 2017’. But, it’s an evolving and mature regulation. Since going live in 2014, there have been two updates to the reporting format. Currently, two main items ESMA and regulators are reviewing is data quality and fines.

With multiple years of EMIR reporting, there is an expectation of improved data quality from reports. This includes trade reconciliation between counterparties that should match, using correct data for reports and reporting all relevant information.

It is expected that investment firms reporting under EMIR conduct internal reviews to ensure that all of their trades are in fact reported and correctly. In addition, firms should periodically review match reports of trades conducted by their counterparties to ensure that both sides are reporting similar data.

When BAML was fined £34.5 million by the FCA last year, they were on the book for having a systematic failure that caused many ETD trades not to be reported. As such, it is believed that the FCA is looking into other cases where firms have a reporting gap which could lead to additional fines this year.

MiFID II in H2 2018

During the event, it was discussed that there has been an unofficial six months ‘grace period’ by the FCA. Due to the complexities of MiFID II, the regulator was more focused on making sure that firms were reporting than diving into the details of the submissions. However, at the event, it was explained that the current belief is that in H2, the FCA is analyzing deeper into firm by firm reports.

The ending grace period was the highlight of points during the MiFID II update from Duff & Phelps. Other updates included:

LEI – It was pointed out that the ESMA delay on requirements to obtain LEIs from clients had expired. Therefore, firms must ensure that their entity counterparties have an LEI in place before conducting further transactions with them (more on the LEI delay expiration)

ISINs – ISIN creation continues to be a problem in the market. Even when they are created in time, regulator databases of ISIN may not be updated to satisfy T+1 reports of new products. Therefore, firms are experiencing report breaches of being unable to report trades on time.

In this regard, it was advised that if a firm believes a product is reportable, then they should report it. Therefore, the FCA advises firms to continue to periodically resubmit MIFIR reports that were rejected because of an incorrect ISIN until the submission is approved.

Trade vs Fill level – One of the problems specifically affecting the asset management sector is whether to report on a ‘fill’ or ‘trade’ level. Many OMS systems don’t aggregate all fill information of an order and only show the aggregated trade information of the average price. Even when fill information is available, it may not be in a format suitable for easily creating MiFIR reports. Due to this problem, and ambiguity of the reporting requirements, the asset management sector has been pushing for clarification on the correct standards.

At the event it was explained that the fill vs trade issue is on the FCA’s radar. However, they have yet to make any updates to their Market Watch 55 report that they published in December 2017. At the time, their opinion was that it depended on the confirmations received by a firm’s counterparty. If the counterparty bank or brokers confirmed individual executions, then they should be reported individually. On the other hand, if the counterparty sends confirmations for the entire trade, than firms can report a single line for the entire trade block.