Latest from the Blog

Pirum and S&P Global Market Intelligence Cappitech extend collaboration to cover upcoming SEC 10c-1a regulation

Following the success of their collaborative SFTR solution, the firms have announced plans to leverage Cappitech data validation, event creation and regulatory connectivity with Pirum's RegConnect, creating an efficient and streamlined reporting...

- Sign up to our Newsletter

Compliance Blog

May 2, 2024

Pirum and S&P Global Market Intelligence Cappitech extend collaboration to cover upcoming SEC 10c-1a regulation

Following the success of their collaborative SFTR solution, the firms have announced plans to leverage Cappitech data validation, event creation and regulatory connectivity with Pi...

July 19, 2021

IHS Markit and Pirum Survey: SFTR Inspires Firms to Consolidate Processes for Regulatory Reporting Regimes

Following the final go-live phase of SFTR in January 2021, this new survey examines whether industry expectations were met, what key challenges remain for SFTR reporting, as well a...

May 2, 2021

DTCC proposes withdrawal of FpML support for North America trade reporting – how does this impact your CFTC/SEC reporting?

Many firms are in the midst of preparations for the CFTC rewrite due to go live in May 2022, the first significant change since the reporting rules went live in 2013. The reporting...

March 24, 2021

IHS Markit wins “Most Innovative Data Orchestration for Regulatory Reporting” from A-Team Innovation Awards

We were thrilled to be awarded “Most innovative data orchestration” in the A-Team Innovation Awards today for our work across the regulatory reporting landscape. The A-Team Inn...

September 24, 2020

Another industry jolt: implications of Deutsche Börse withdrawing from the regulatory reporting market

2020 has been a wild ride for the regulatory reporting industry with some of the most unlikely twists and turns we have seen in a long time (and that is not even factoring in COVID...

August 27, 2020

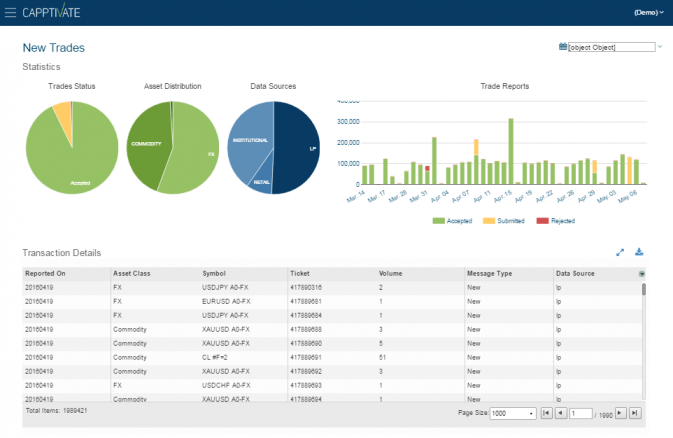

Cappitech completes first vendor-led porting of historical and current data from CME–reports to REGIS-TR

With limited time until all porting must be completed, Cappitech calls for financial institutions to ensure they have their porting slots booked and prepared for

Cappitech has ...

August 6, 2020

Cappitech selected as a “Top 21 RegTech Company” & “Big Disruptor” in the regulatory reporting vertical by Medici & EY

Recently, Medici and EY released a new analysis of the RegTech market to identify the top 21 companies offering innovative Regtech solutions across different regions and segments. ...

January 21, 2020

Red Deer and Cappitech partner to offer a complete solution for MiFID II reporting, Best-Execution Monitoring and MAR compliance

Red Deer, the financial technology company dedicated to enhancing the performance of active investment managers, and Cappitech, a leading provider of regulatory reporting and intel...

April 15, 2019

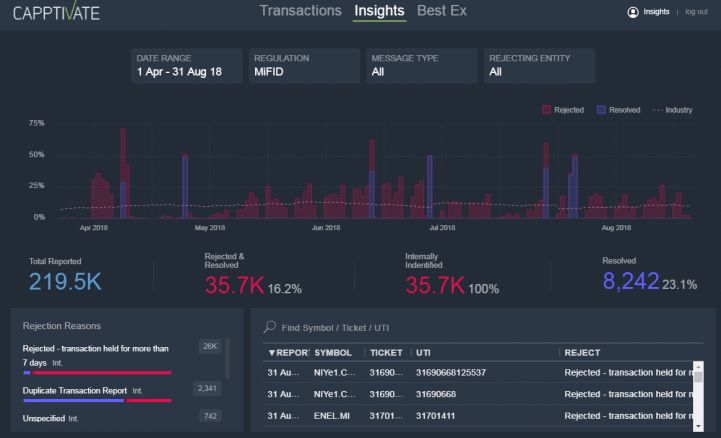

Cappitech Launches MiFID II Market Intelligence Product, Enabling Financial Institutions To Monetise Regulatory Reporting Data

Cappitech announces the launch of RTS 28 Market Intelligence, a product that allows financial institutions to use regulatory compliance data to their own advantage. The electronic ...

February 21, 2019

Best Execution: Essential for Asset Managers and Hedge Funds Looking to Comply and Improve Performance

Yield and performance. The heart of every asset manager's business. The driving force behind the day-to-day activity of buy-side firms. Yet, how many of these firms view complying ...

November 30, 2016

EC EMIR Review – 2017 could bring regulation changes to streamline reporting and ease NFC and clearing obligations

The European Commission (EC) has issued their Review Report on the European Market Infrastructure Regulation (EMIR) which went into effect in 2014. With a mandate to provide transp...

July 6, 2016

UK Trade Repositories and EMIR after Brexit, the future of unified global derivative reporting regulation

With the UK potentially slated to leave the EU following the Brexit referendum vote, it has triggered speculation as to EMIR regulation will continue to be applied to British firms...